What Is Xpress-pay?

A powerful online & mobile ePayment system that lets you:

1. Instant Payment

Xpress-pay presents a form allowing the visitor to complete the information

and the amount to be paid.

2. Posted Bills

Xpress-pay clients upload bills to the Xpress-pay database. Visitors provide

search criteria, and Xpress-pay presents matching bills (EBPP).

3. Secure Payment Portal

The organization’s site engages in a dialog with the visitor to determine the payment amount. Payment is then completed either at the Xpress-pay site or via a secure iFrame at the originating site.

4. Xpress-pay Global aXcess

Similar to Option 2 above except that bills are retrieved in real-time directly from the organization’s database. The organization is also immediately advised of successful payment.

How You Win

ePayments - How It Works

Offering electronic payments is far more involved than one might imagine. The commitment for infrastructure, programming, security, and PCI DSS certification is staggering, making it off limits for most organizations. Even the largest firms do well to engage the services of an ePayment specialist.

Global aXcess

Xpress-pay offers several options, with Global aXcess being most attractive to larger organizations and solution providers. Global aXcess provides real-time access to accounts receivable data, presentation for payment, and instantaneous payment updates to the client. With the Global aXcess framework already in place and operational, all that is needed for integration are two basic merchant based API’s.

Application Programming Interface (API)

API documentation is generally provided by the servicing vendor, in this case, Systems East, Inc. (Xpress-pay). Since Global aXcess leverages the merchant’s (or provider’s) API’s, we simply need a copy of your API documentation so we can author custom components that allow Global aXcess to communicate as needed to fetch bills and apply payments.

If you currently do not have an API for these two purposes, they will need to be developed. With respect to requests and responses, we can honor JSON (preferred), SOAP, or OAuth. Bill query responses can be for a balance due or contain an array of outstanding bills. Payment advice from Xpress-pay will always contain a nested array.

We will author a submission to query your database. Since every integration is custom, the parameters will be unique to your organization. In insurance for example, we might submit a policy number and zip code. You would then respond with an array of outstanding items for that policy. Both the query and the response parameters are determined based on discussions between our firms.

The same is true for the real-time advice to be provided to your API immediately after each successful payment. We will submit an array echoing information you provided in the bill query, supplemented by payment-related information such as date, time, transaction ID, and amounts.

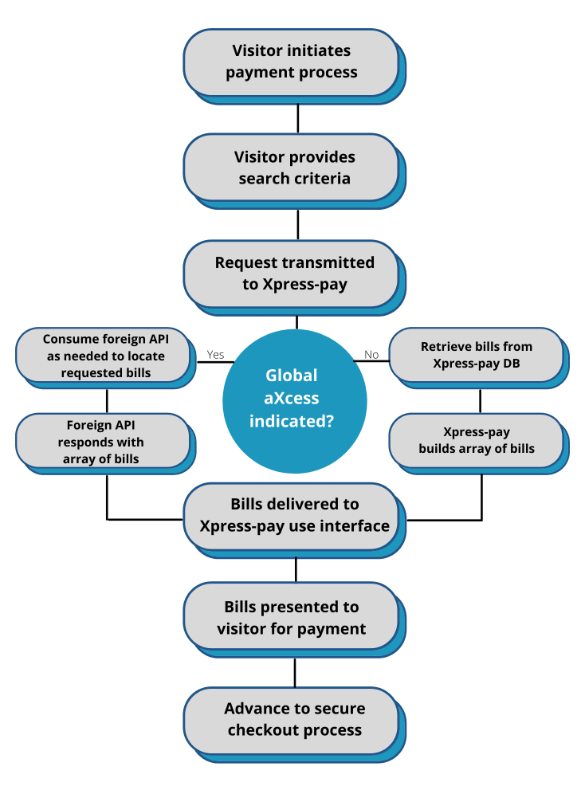

Bill Retrieval Process

Typically, the process is initiated by a visitor navigating to the merchant’s site. Starting there is an important component in providing the confidence necessary for the visitor to continue, knowing that sensitive information is soon to be communicated. This chart provides a graphic representation of the difference between Xpress-pay Posted Bills and Xpress-pay Global Access:

Simply stated, if Global aXcess is in play, Xpress-pay queries the foreign database for bills instead of

the Xpress-pay database. Bills matching the visitor’s query are then presented for payment, along with

the following possibilities:

- Payment amounts for each bill can be enforced as delivered or, if the merchant permits, Xpress-pay can accept partial payments, overpayments, or either.

- Where more than one bill is presented, one or more can be selected for payment. It is also possible to limit selection to only one bill. This is helpful in the insurance industry, where a consumer must choose between an installment or full payment.

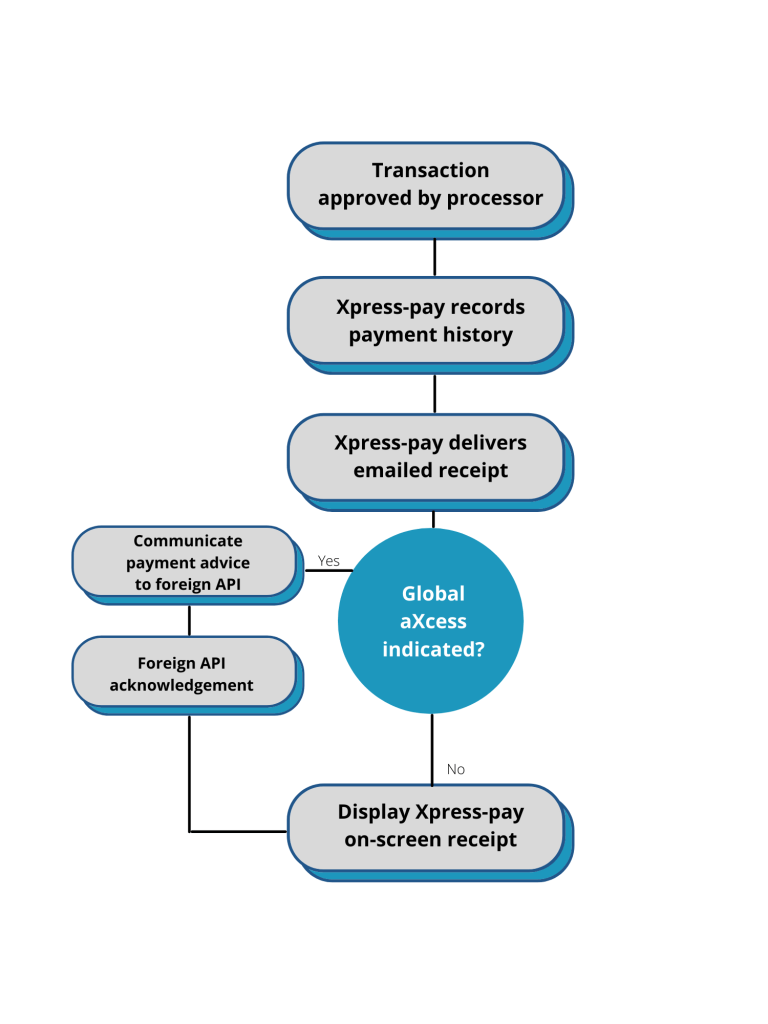

Real-Time Payment Advice

Upon payment, Xpress-pay records a history record and issues an emailed receipt to the visitor. If

Global aXcess is in play, the client’s database is updated in real-time. The visitor is then navigated to

the on-screen receipt:

With Global aXcess, an asynchronous post is instantly delivered to the merchant’s API for processing.

Global aXcess performs all exchanges in real-time, providing a secure and efficient method of

extending ePayments to everyone you serve.

Your Global aXcess project starts with an exploratory discussion to determine the capabilities of your

API suite. If you do not have one, only two API’s will be needed, one for retrieving bills, and a second

to accept real-time payment advice. The parameters and response strings are entirely dependent upon the criteria upon which your searches are to be dependent. Your web developer can provide guidance and pricing for these components.

Since the entire framework for Global aXcess is already in place, the charges from our firm will be

limited to the time & expense relating to the custom programming needed to interface with your unique API’s. Assuming you have capable API’s and a qualified project liaison, thirty to forty staff hours is a reasonable initial expectation. Please contact your Xpress-pay representative to obtain the current programming rate, an estimate, and to make arrangements for the initial discovery meeting.

Thank you selecting Xpress-pay for your ePayment needs. We stand ready to assist you in achieving success with your ePayment project.