One issue facing all small business owners is effectively tracking financial data. While most business owners are aware of the need to track their income and expenses, not all are equally diligent when it comes to their cash flow.

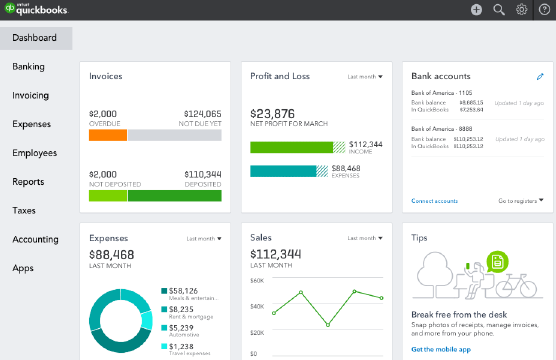

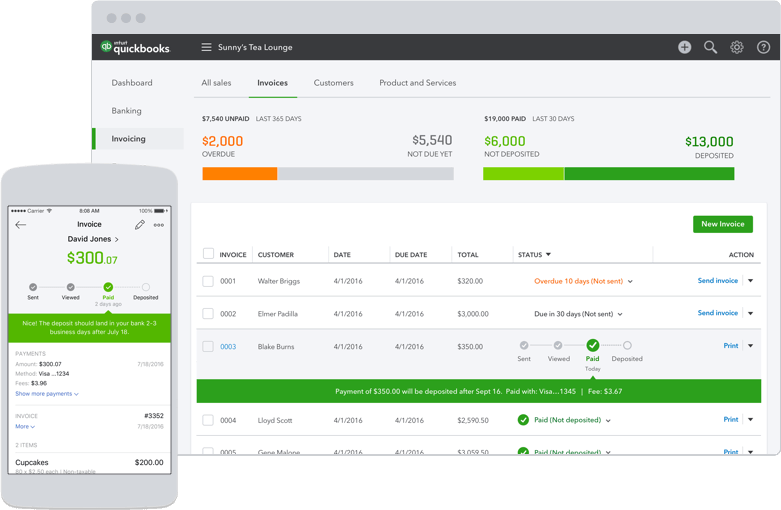

If you’re just starting out, now is the time to choose bookkeeping solutions like QuickBooks Online or Sage to eliminate many common financial headaches both today and in the future. Established businesses may also find that their current system doesn’t provide the information necessary to meet their needs. A software update may provide the solution those companies need.

Regardless of your business’ longevity, taking advantage of specific accounting strategies makes monitoring finances far easier. There are basic steps every small business can take to track cash flow. Here are just a few tips every small business owner can use when auditing their company’s finances.

Don’t Comingle Personal and Business Funds

If you’re reviewing tips for small business owners, separating your personal and business finances will almost always be one of the first items listed. Always take the time to establish separate accounts, and never use personal accounts for business or vice versa. Doing so is a recipe for disaster. It’s virtually impossible to determine where problems exist if there is no clear, concise record of income and expenses for the business.

Get Professional Advice

While contemporary software is relatively intuitive, it always pays to get professional advice when setting up the software. Your accountant will generally be a great source for information and advice when customizing the software for your company. The accountant can help you prioritize the information necessary to track income and expenses so you’re always on top of the company finances.

It’s also a good idea to take advantage of available tutorials before trying to make use of the many available functions. Once you’ve learned the basics, it’s far easier to understand the nuances.

Make Sure Your Software is Secure

You may feel that no one really cares about your small company’s books, but that’s not a safe assumption to make. While cybercriminals may focus on larger companies and organizations, it’s never a good idea to assume your records are safe. Ignoring security protocols puts your data and client information at risk.

The first step is to set a secure password. The password should always be a mix of upper- and lower-case letters, symbols, and numbers. Never use simple combinations that are easy to guess. The most common password in 2020 was “picture1.” The second most common password was “password.” Never use those passwords and others like your birthday, anniversary, pet name, or similar personal data. They’re too easy to guess.

Next, be fussy with who has access to QuickBooks. While some employees will need to use the program, don’t let anyone without a specific need to see or enter data. Train employees that have access to log out when they’re not actively using the program.

Review the Data Often

Far too many small business owners routinely enter their data in their accounting system but then fail to review the information. Yes, the information is needed to file taxes, but the information also provides an insight into your organization’s operations that’s too valuable to ignore. Your accountant will provide insight into how often to review the data, but most experts recommend going over the information at least once per week to spot anomalies before major problems develop. It’s also easier to locate the information needed to correct mistakes if it’s relatively fresh in your mind.

Learn and Use Available Reports

One of the benefits of current software is its ability to generate a wide variety of reports tailored to meet different users’ needs. The tutorials can be helpful when deciding what types of reports are needed and how to create them, and your account or computer experts may also provide ideas and hints. The bottom line is that they are just reports – run all of them to see which are most useful to you.

Some examples of reports are profit & loss or cash flow statements and balance sheets. Each is important, and the software should make it relatively easy to customize them for your company.

The software can also provide reports outlining open sales orders, pending sales, open purchase orders, and a variety of other information required to keep your small business profitable. The trick is to understand which reports are needed, as it’s easy to be overwhelmed by data if you start obsessing with too many reports.

It’s also important to remember that, in many cases, a summary-level report may serve you better than a lengthy detailed report. If more attention is needed in specific areas, use detailed reports to provide more information.

Explore Online Integration Options

As an example, QuickBooks is great software, but the way it accomplishes certain objectives might not coincide with your expectations or needs. For example, QuickBooks can accept online payments, but it’s expensive. The QuickBooks Online Integration feature through Xpress-pay can alternatively be used for online payments. It has the ability to retrieve invoices, accept payments, and mark invoices as paid, but at a significant savings to you.

Xpress-pay integration is certainly an area where working with trusted advisors may produce ideas and strategies that enhance you business and its profitability. Your accountant or computer expert may have other ideas on how to integrate third-party software with QuickBooks.

Track All Business Expenses Carefully

Every dime spent must be accounted for to maximize your profits. That means even small things, like copy paper and pens, must be tracked to minimize waste. Reports will provide information that will help you identify areas where it might be possible to cut costs.

For example, if your utility expense seems to high, explore ways to cut costs. That can mean shutting off lights in areas that are not used or adding window film to reduce air conditioning demand. In areas where utility providers compete, review the costs for each and make changes accordingly.

Routinely monitoring expenses also makes it easy to spot trends. For example, excessive costs for facilities and grounds management and maintenance. In some cases, there is no good way to reduce cost, but don’t overlook opportunities. Keep an open mind when seeking new ideas.

Explore Options for Automation

Wherever possible, automate your company systems to reduce the need manual entry. Your software likely makes some processes, such as bill payment and reconciliation, simpler, but it’s often necessary to use third-party software for other online integration processes. Review the options with your accountant or computer expert to better understand how automation can eliminate much of the tedious manual entry faced by employees every day.

One area where integrating third-party software pays off is tracking employee hours. There is software that allows employees to clock in and out using online programs that integrate with the QuickBooks Employee Center. Since the software can be optimized to meet your company’s needs, processing the payroll becomes simpler.

Be Ready for Tax Time

With information readily available, you’ll be far better prepared for tax time. With all transactions properly entered, your accountant will find it easier to gather all the data required to generate all tax documents. This may well reduce their bill too.

Remember that business tax requirements are far different than your personal taxes. This suggests that it pays to ensure you’re capturing all the data the accountant needs throughout the year. To accomplish this, you must work closely with your accountant during the initial setup process. However, even if some data isn’t included on the reports your accountant needs, your software should make it simple to locate the missing information quickly.

Plan Ahead

In many instances, small business owners fail to prepare for unexpected expenses. Use available reports to spot trends that indicate upcoming expenses, noting that not all costs can be predicted. Ask your accountant to suggest strategies to reserve some cash for those unplanned but inevitable expenses.

The recent pandemic pointed out many shortcomings of pre-COVID business strategies. Just-in-time practices, for example, make it difficult to cope when supply chains are interrupted. Even when materials and supplies can be located, they may cost more than originally budgeted. Plan for contingencies now rather than waiting for issues to develop.

Track Vendors as Well as Customers

Even during normal times, tracking vendors is crucial. Using the accumulated information will allow you to evaluate the performance of vendors. Are deliveries made on time? Is the vendor’s billing accurate and detailed? Is their pricing stable? Are quality issues becoming a problem? Regardless of the type of business, reviewing the performance of vendors provides important data and allows company owners to determine if choosing new vendors may be appropriate.

Track Vendors as Well as Customers

Finally, understand that your needs will change, and adjust how your business’ software is used. That might mean altering what types of data are recorded as well examining your choices for third-party software.

There are many tools available to you. Combined with your expertise and the guidance of the professionals you engage, you can keep your business on course for a healthy expansion.