Biometric tech has become part of our everyday lives, and industry experts predict that more than 1.4 billion mobile phone users will rely on some form of it by 2023. As biometrics becomes more prevalent, merchants everywhere are learning how the technology can bring convenience and simplicity into the retail environment.

Despite its growth, many are questioning the security of biometrics. With anecdotal reports of spoofed fingerprint sensors and bypassed facial recognition, security is at the forefront in the industry—and that may be why over 90% of merchants identify security as their main concern around the use of biometric payment methods.

- With these issues in mind, sellers interested in improving the customer experience with biometrics may wonder how secure the payment method is and how they can simplify the adoption process. Here’s what they should know.

Biometric Payments: What’s Involved?

Biometrics is the use of behavioral or biological traits to identify people. It may be an iris scan, a fingerprint, a vein pattern, or someone’s voice. It’s becoming an ever-popular technological feature; if you use facial recognition or a fingerprint to unlock your mobile device, your identity is verified via biometrics several times a day. Therefore, a secure digital payment isn’t a huge stretch of the imagination.

Here’s a basic outline of the process:

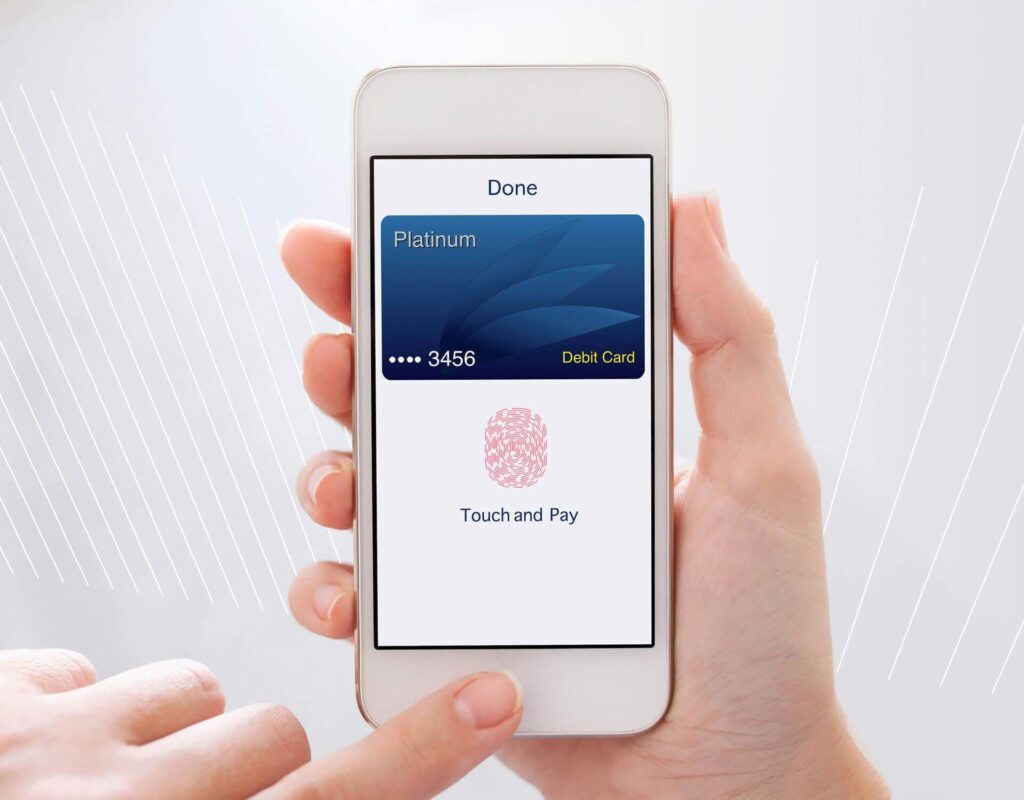

· A user is identified by their biometric traits.

· Their identity is confirmed by a copy of that trait, which is stored in an encrypted form in a secure database.

· Once the user’s identity is confirmed, the payment method linked to their account is charged at the point of sale.

Now that we’ve gone over the basics, let’s explore a few ways biometric payments can potentially improve customer service and boost companies’ bottom lines.

A Safe and Sanitary Experience

Imagine it: a person waves their palm over a scanner in the grocery check-out line. They’re not touching the PIN pad, and clerks aren’t required to disinfect the hardware several times per hour. Biometric payments will allow customers to leave with a sense of reassurance and safety, knowing that they haven’t touched equipment that thousands of others have handled before. As evidenced by recent trends and the events of the past two years, contactless payments aren’t going anywhere.

Reduced Administrative Expenses

Banks incur significant admin costs when utilizing conventional identification methods. Whether it’s producing card readers, sending PIN information via the mail, or verifying customers’ identities, documentation is expensive. Conversely, biometric payments allow financial institutions to reduce paperwork while securing and simplifying processes.

Less Logistical Stress, Faster Payments, and Fewer Frustrated Customers

All of us have shopped during the busiest hours of the day. Whether it’s a restaurant, a retail outlet, or a grocer, it’s easy to be inconvenienced by long lines and extended wait times. Along with the hassles these events cause for customers, they also make it harder for workers to do their jobs. When backlogs happen, biometric payments can safely and securely shorten wait times. Shortening the check-out process lessens the stress of a busy day—for staff and shoppers.

Easier Operation of Customer Loyalty Programs

When loyalty programs are combined with biometric payments, there’s no need for customers to punch or scan a card, which makes it easier for everyone. As a shopper pays with biometrics, points are added to their accounts and rewards are redeemed effortlessly. If point tracking becomes more convenient, shoppers are more likely to be brand loyal.

Increased Payment Security

Depending on the biometric markers used to initiate payments, the security of a person’s payment data can be significantly increased. For instance, if a bank uses palm vein scanners to verify customers’ identities, it would be almost impossible to duplicate a user’s vein pattern and access their information.

However, if retailers or banks use facial recognition software, it’s a different matter. Hackers quickly figured out how to bypass these systems, and facial scanners often misidentify women and those of color. That’s why facial recognition is rarely recommended as a secure biometric payment method.

Another security benefit of biometric payments is that users don’t have to carry physical cards to complete transactions. That means they no longer need to worry about losing a card or having it stolen from their cart, wallet, pocket, or purse. Not only will there be less of a need to replace lost and stolen cards, but banks will also reduce their liability costs and overhead expenses.

Future-Proofing Businesses

As the pandemic goes on, contactless, convenient biometric payments will help businesses adapt to the changing times without sacrificing customer service. With this safe and secure payment method, you can serve customers while keeping them and your team safe.

Biometric Data Privacy Concerns

Unlike identification cards and passwords, collected biometric information is hard to forge—making it an effective way to confirm an individual’s identity. However, that also means it’s more difficult to change the information in the event of a breach. Every person’s biometrics are unique, and that means security and privacy measures must be carefully evaluated when systems are designed and implemented.

Since the earliest days of biometric system development, civil society and human rights groups have asked for additional security measures. Their primary concern is that, if proper safeguards aren’t implemented, biometric systems may do more harm than good. These groups also demanded that data be erasable in the event of a major data breach or economic upheaval, but the extent of these protective measures is still unclear.

A bigger challenge is if threats aren’t handled properly and contingency plans aren’t implemented when developing biometric identity systems, consumers’ confidence may be eroded—and the full potential of biometric payments may never be unlocked.

Tips to Ensure the Security of Biometric Data

When a customer’s biometric data is captured, it’s stored in template form—and the template cannot be changed back into the original characteristic. Like tokenized data, these templates, when stolen, are not representative of the information from which they arise. Despite these measures, sellers should take steps to secure their customers’ biometric data and protect it from breaches.

The most important factor in the security of biometric data is how the templates are retained. They shouldn’t be attached to user identities or stored on the same servers to keep hackers from connecting the two. Methods such as encryption and tokenization are good ways to protect biometric data, and public key infrastructure also helps to secure data by spreading information across keys.

Another effective solution is to use authentication methods that store data on users’ devices, which eliminates the risk of a wide-scale breach. Hackers would need to steal individual users’ devices to capture their data, which isn’t just inefficient, but highly unlikely.

Reassure Buyers That Their Data is Private and Secure

An important part of providing a memorable customer experience is making buyers feel secure and at ease—especially where new technologies are concerned. When a customer first enrolls their biometric markers, encourage them to provide their contact information for use in the unlikely event of a data breach. And, To keep them updated when changes occur, ask them to update their information regularly. These steps, while simple, give customers a feeling of control over their biometric data while keeping security at the forefront.

According to a recent survey, almost 90% of respondents believe that security is a crucial attribute when selecting a payment method. That’s why it’s important to make customers feel safe when making a payment using biometrics. When merchants educate their customers, they will know just how secure they are. An easy way to do it is to post information on the company’s website about biometric data and how it’s being protected.

Another effective way to communicate with customers is by training sales team members to answer questions about the security of biometric data. The easier it is for customers to access information on the security and inner workings of the technology, the more at ease they’ll be when using it.

Biometric Payments: Paving the Way to a Better Customer Experience

Biometrics are quickly becoming a crucial component of the customer service experience. As this technology becomes more common, we’ll likely see multi-biometrics—or technologies that authenticate multiple traits at the same time.

Understanding biometric payment technology is an important step in bringing it into a retail outlet, as is knowing how to ensure the security of customers’ data. To accomplish these goals, sellers must carefully consider how that data is stored and shared. Efforts to secure sensitive data should be explained to customers as part of the user experience, which, when done properly, will encourage the widespread adoption of the technology.

A Bright Future for Biometric Payments

As today’s consumers become accustomed to confirming their identities with biometric data, we expect that facial recognition, iris scans, fingerprints, and other approaches will be used for more in-store and online purchases. Financial institutions offering these options to customers, whether in card or digital device, will become industry leaders while benefiting from enhanced security and reduced overhead. If customers’ data is kept secure and the effects of data breaches are minimized, biometric payments may become the world’s preferred way to buy and sell.