American consumers hold a lot of debt, but that doesn’t mean they can’t get their finances in order and improve their credit scores in the process. Paying bills on time is one of the best ways to boost credit scores, avoid late payments, and reduce consumer stress, but financial literacy doesn’t always come naturally.

The good news is, there are plenty of ways to change bad financial habits. Setting up automatic bill payments is a simple way to avoid late payments by removing problems like forgetfulness and procrastination from the equation. Read on to find out how to avoid late payments using bill pay and develop other good financial habits.

What Is Automatic Bill Pay?

Automatic bill pay lets consumers schedule money transfers to credit card companies, utility providers, insurance brokers, and just about anyone else who charges recurring payments. Consumers can use online bill pay to stay on top of even complicated payment schedules without having to lift a finger beyond setting up their accounts. The payment will be processed through an electronic payment system, and the money will be debited from the consumer’s bank account at the same time every month.

A Brief Example

To get a better idea of how automatic bill pay works, let’s take a look at one very basic example. Say a driver takes out a car loan. The terms of her loan require her to make $300 payments on the first of every month for 60 months until the car is paid off. Without automatic bill pay, she’ll have to sign into her online account with her loan company to schedule the payment before it’s due each month. Missing just one payment could leave the driver with late fees, and repeated missed or late payments could impact her credit score.

With automatic bill pay, she doesn’t have to worry about any of the issues described above. Instead of remembering to sign on and make a payment each month, she just has to set up recurring payments through an online payment service. The service will remove the $300 from her account each month automatically, transferring it to the auto loan company on a pre-determined date before the bill is due. The driver is relieved of remembering to pay her bill or dealing with the consequences of late payments.

The Benefits of Automatic Bill Pay

Setting up automatic bill pay is the easiest way to stay on top of recurring payments. Working with an online vendor allows consumers to manage all their bills using the same platform from the comfort and convenience of their own homes. The best part is, taking advantage of auto-pay platforms also comes with a host of other benefits.

Save Time

Consumers spend a lot of time keeping track of finances and paying bills, especially if they still use antiquated methods like writing and mailing checks. Paying bills automatically removes dealing with checks from their to-do lists, freeing up time for more satisfying activities.

Save Money

Many companies, from cable providers to auto loan servicers, offer discounts to customers who set up auto-pay. Even if none of a consumer’s service or loan providers offer auto-pay discounts, they’ll still save money by ordering paper checks or requesting money orders from their banks less frequently. Plus, they’ll never have to worry about paying late fees and penalties.

Improve Credit Scores

Payment history accounts for 35% of a consumer’s FICO credit score, and while other credit reporting agencies don’t offer information about percentages, they’ve admitted that on-time payments are still very influential. If people forget to pay their bills for just one month, they can wind up with a black mark on their credit reports for 7.5 years. Setting up auto-pay means that as long as consumers have a sufficient balance in their bank accounts, they’ll also automatically have better credit.

Reduce Financial Complications

Using a third-party payment servicer to pay bills automatically online can dramatically simplify budget management. Consumers will be able to view all of their recurring monthly expenses from a user-friendly dashboard and compare them to their income to determine how much discretionary spending they can afford each month.

The Risks of Automatic Bill Payments

For most people, the benefits of auto-pay outweigh the risks. However, there are a few things consumers need to keep in mind if they want to use this valuable tool to improve their credit scores and get their finances back on track. Here’s what people need to know going into automatic bill pay programs:

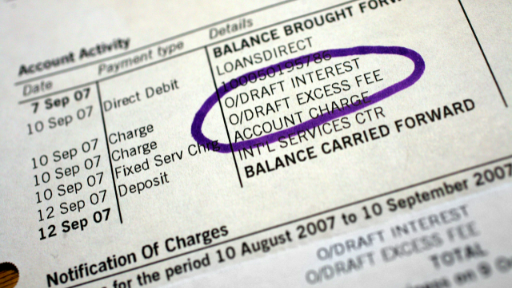

Risk of Overdrafting Accounts

As with any online payment, automatic bill payments will only go through if consumers have enough money in their associated accounts to cover them. People who have overdraft protection measures in place may find that they still wind up late on payments, while those who allow their accounts to be overdrawn may find themselves facing steep fees from their banks.

Though auto pay can play an essential role in helping consumers get ahead of their debts, it’s only part of the plan. People still need to be mindful of their finances by balancing their accounts and paying attention to how much money they have in the bank at any given time. Try creating a budget plan that accounts for auto payments to keep monthly finances on track.

Charges for Unnecessary Services

Setting up automatic payments can increase the chances of forgetting to cancel unused services. Keep a list of all the household expenses and subscription perks. Revisiting the list at the end of the month may remind those responsible for paying the bills to reconsider whether or not a particular service is really necessary.

Not All Companies Accept Auto-Pay

Not every service provider or lender accepts auto-pay. The best solution to dealing with this problem is to find companies willing to accept automatic bill payments through third-party payment processors. Even if consumers can’t eliminate 100% of their manual bills, though, automating everything possible is still a great way to save time and simplify finances.

Forgetting to Change Credit or Debit Card Info

Forgetting to update the payment information when a credit or debit card expires can leave consumers dealing with missed payments and additional fees. The best way for people to avoid this problem is to sit down with a list of all their monthly bills and go through each of them, changing the information as needed, each time a card expires.

Additional Tips for Using Auto Pay Responsibly

As discussed, auto bill pay can be an incredibly helpful tool for people who want to get their finances in order and improve their credit scores. Like all tools, though, it must be used responsibly. Here are a few tips to make the most of auto pay missing payments:

- Set up a bill pay calendar with reminders for when each bill is due and remember to check the associated account to ensure that it has enough funds to cover it.

- If possible, try to keep a cash buffer in the checking account to cover bills that could be overlooked

- Keep a comprehensive list of all household expenses, including not just those set to auto-pay.

- Set up alerts through the bank that will send a notification when the user’s balance starts getting low.

- Log in to mobile banking and payment processing accounts at least once a week to review payment histories for suspicious activity.

- Update credit and debit card information each time a new card is issued.

- Consolidate bills for things like phone service, internet access, and cable to simplify monthly budgets and save money.

- Set up auto-pay to send payments to creditors or service providers a few days in advance to compensate for things like weekends and holidays.

What to Do When the Bills Won’t Get Paid

Most American consumers experience at least one period of financial hardship in their lives. While admitting that there’s not enough money coming in to pay the bills can be embarrassing and stressful, but ignoring impending financial emergencies is never the right approach. If there’s not enough money to cover bills set to auto-pay, take action in advance instead of allowing their due dates to pass by.

The correct is to reach out to lenders or service providers to discuss options. Every company is different, but many will work with reliable customers to create alternative payment options.

Final Thoughts

Automatic bill pay is one of the best tools for busy Americans who want to stay on top of their finances. By following the tips and best practices laid out above, missed payments, damaged credit, and late fees or penalties can be avoided.